|

|

|

|

It would seem obvious: A bonus is income and gets withheld and taxed just like the money in the regular paycheck. But in reality, it’s more complex than that. Click through for details so no one faces unpleasant surprises at tax time.

|

|

|

Residential solar power has come a long way. What do you need to know as people turn to more renewable energy sources? Could it be a solution for your home—and is there a tax break? Click through to learn more about solar power in your home.

|

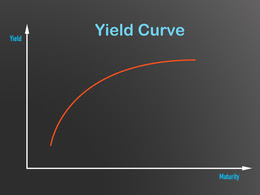

The yield curve, a graphic depiction of interest rate paths, can be hard to understand and interpret, and yet it remains a bellwether for investors. Click through for a brief overview of what it means, to help you take charge of your investment strategy.

|

|

|

Talking about pay with employees can be uncomfortable — even for experienced managers. But if you plan it right, the talk can be profitable for both parties. Click through for strategies on navigating pay discussions with your staff.

|

Payroll administration is complex, so you’ve outsourced the process to a third-party payroll provider. But that doesn’t relieve you of your responsibilities. Click through to make sure you’re following your legal obligations no matter what your situation.

|

|

|

|

Saved Articles

Comments and Feedback |

Refer A Friend

Your Privacy |

| Our firm provides the information in this e-newsletter for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax articles in this e-newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose. |

Powered by

|

|

Copyright © All rights reserved.

|

This email was sent to: [email protected]

Mailing address: 176 Granite St., Quincy, MA 02169

|

|

|